Africa is leapfrogging traditional and legacy banking payments systems in use in much of the developed World through fast adoption of mobile and internet based technology. Cutting edge blockchain technology such as Bitcoin has great potential in creating efficiency and disrupting traditional mechanisms for international trade, resource management, and governance where current transaction costs are high due to existing bottlenecks such as poor infrastructure, corruption and mismanagement. However, huge challenges remain creating obstacles in the adoption of these innovative technologies worldwide.

Bitcoin in particular has in the recent past generated a lot of controversy with the Central Bank of Kenya issuing a public notice warning against the use of bitcoin as a currency within the country. While currency regulation and monetary policy is within the purview of the Central Bank, it is important to dig deeper into what could be the most revolutionary technology of our age and how best we can we move forward with ensuring Kenya and indeed the African continent exploits fully the opportunity that is now within our grasp.

Make no mistake Bitcoin and its underlying Blockchain technology will disrupt the current financial order that currently has Banking institutions sitting at the top of the food chain. Incumbents who fail to understand and implement strategies risk being rendered irrelevant akin to the manner in which Kodak was rendered irrelevant by the advent of Digital Cameras. Indeed Kenyan Banks have already had a taste of this with the arrival in 2004 of M-Pesa the Mobile Money platform that revolutionized the way Kenyans transfer money and pay for services within the country. Already it is estimated that 40% of Kenya’s Gross Domestic Platform is transacted on this platform. Banks and other financial institutions will need to evolve once again to keep up with this global trend.

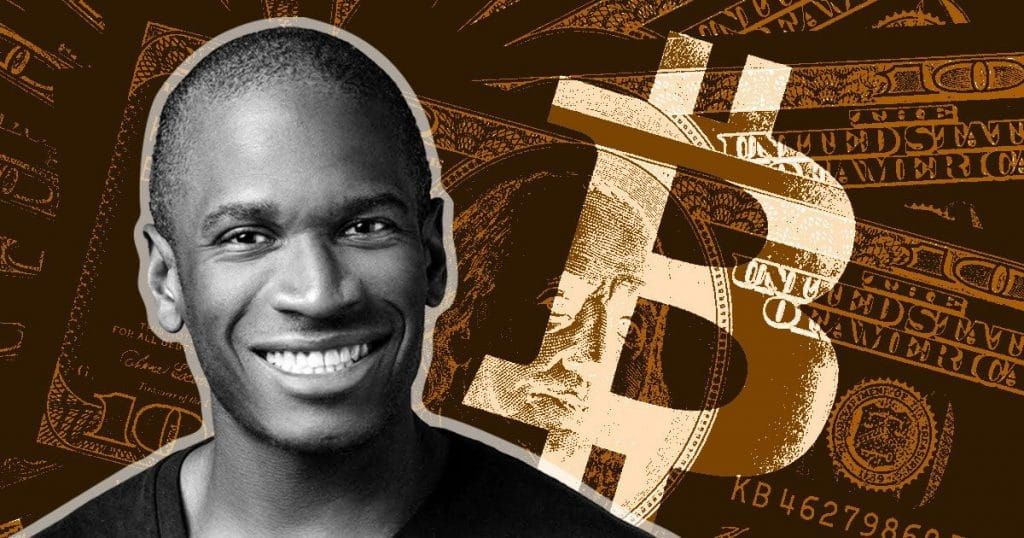

Digital currencies and in particular crypto-currencies in general have evolved rapidly during the past eight years since the advent of bitcoin the World’s first truly decentralized crypto-currency. Bitcoin invented in the year 2007 by an anonymous person or entity known as Satoshi Nakamoto has forever revolutionized the way the transfer of value occurs between two or more parties who do not trust each other. The space continues to evolve rapidly with hundreds perhaps thousands of crypto-currencies being created every day, most of which are either irrelevant or scams that offer little or no value to society.

Bitcoin the World’s first Decentralized Crypto-Currency is quickly positioning itself as the Internet of Money; a platform that will allow for instantaneous, immutable and secure exchange of value almost for free and at any given time. Bitcoin possesses 4 key distinct characteristics that will allow for this transformation to occur namely:

- Bitcoin the Blockchain; the distributed open ledger maintained and safeguarded by the network of miners i.e. Computers that ensure transactions cannot be forged.

- Bitcoin the Currency; the digital token used for transactions and to reward miners who secure the network and Blockchain.

- Bitcoin the Protocol; the digital network used to carry bitcoin currency transactions across the network.

- Bitcoin the Software; the open source code allowing for extensible and evolution of the platform in the future. Read the Bitcoin Whitepaper here.

What is Bitcoin?

It is important to note that bitcoin the currency is the first successful application of Bitcoin the Platform. African Regulators should assess the potential of Blockchain technology to reduce costs and enhance transparency within multiple sectors of the economy. For example Blockchain technology could eventually provide mechanisms to seal corruption loopholes and track illegal activity such as money laundering at very low costs. Indeed Blockchain technology has in the recent past become quite popular with Western Banks and Financial Institutions seeking a way to decentralize storage of information away from traditional databases like the dominant SQL technology. Indeed a number of banks in the United States have formed a Consortium called R3 CEV that intends to develop its on intra-bank blockchain protocol for secure settlement of money transfers between themselves. The World Economic Forum in Davos recently hailed the Blockchain technology as a revolutionary platform that will dis-intermediate costs associated with middlemen in the remittance space, saving the consumer billions in transfer and other associated costs.

What is Blockchain?

Blockchain technology offer promising solutions in the following areas:

Transaction Privacy: Privacy has become huge business with numerous data leaks that have happened over the years it is now apparent that no data is safe within the current centralized client server architecture. Many blockchain projects are attempting to resolve this issue using cryptographic means. Take for example the Panama Paper leaks, where millions of pages of data regarding offshore companies registered was leaked on the internet. While some of these leaks contained data on illegitimate dealings some of the leaks touched on established companies that were setting up offshore accounts to store wealth or move funds internationally. Some blockchain based projects are seeking to make transactions much more private while still maintaining public blockchains that are still accessible but obfuscate both the sender’s and the recipient’s identities during transactions.

Digital Asset Management: The exchange of assets and property has been in the past extremely difficult not just in Africa but in much of the developing world. This is because centralized authorities are plagued with twin challenges of corruption and inefficiency, largely due to the lack of infrastructure and technology to govern processes around these activities. Consider Kenya for example; a newly designated middle-income country with rapidly growing urban population with dwindling land resources which has resulted in the steep appreciation of land and property values in the past decade. This has resulted in huge competition for scarce land and the exponential increase in prices of this commodity. This is due to an old an antiquated land registry system that creates incentives for corruption and even murder.

Smart Contracts: Blockchain offers unique opportunities to provide new structural frameworks to provide transparency into property ownership and exchange through a public disturbed ledger accessible by a country’s citizens or even a company’s shareholders. This can be implemented through the use of smart contracting platform like Ethereum which is a It is a public blockchain program that has some programmable transaction functionality. It uses a programming language that makes it possible for any developer to build and publish next generation distributed applications. The system has a centralized machine capable of providing a peer to peer contracts. This is done using crypto asset known as Ether. The system runs systematically as programmed without any possibility of down time, failure, censorship, fraud or any third party censorship using apps that run on a custom built blockchain with powerful infrastructure that can move the value around and represent the ownership of property. This enables developers to do various things like creating markets, storing lists of debtors, and moving funds according to the instructions already programmed without involving middlemen. In a traditional architecture, every app has its own servers that run code in isolated silos, hence making sharing of data difficult.

Micropayments: Developers across the World and especially in Africa have struggled to monetize their applications due to a lack of an open and accessible global payment network, until Bitcoin. Current systems like paypal and even M-Pesa have restrictions and barriers to entry for young developers who do not have the resources to comply with necessary regulations or interface with these platforms technologically due to the prohibitive costs. Industries such as the Music industry can also benefit from Blockchain technology by creating a distributed ledger that allows for the permanent recording of copyright of music created by artistes for both tracking and collection of royalties through micropayments for their works of art. Such solutions can help resolve problems associated with existing institutions such as the Music Society of Kenya(MSCK) which artistes claim is not a transparent institution and is failing to disburse royalty payments to member artistes.

Elani on Corruption at MSCK. Can the Blockchain solve this problem?

Decentralized Applications: Existing cloud solutions are expensive and remain out of reach of many in the developing World especially Africa where the lack of infrastructure makes it expensive to store data locally. The fact that most cloud solutions are price in foreign characters makes it challenging for Developers to pay for this services with local currencies. Decentralized storage solutions offer a solution, as they allow for payments on a pay per use model using digital currencies like Bitcoin which can be accessed easily from peer to peer markets. Peer to peer decentralized markets offer buyers and sellers a place to meet and trade without involving third party intermediaries that charge exorbitant fees to settle trades. While Bitcoin does offer some reprieve as an open payment protocol, its current characteristics as being a slow payment platform does not yet allow for applications that need instant payments or even micro-payments.

In conclusion Bitcoin and other Blockchain applications are creating an Internet of Value where individuals will become even more empowered. Prudent regulation that protects consumers by ensuring third parties that build solutions on top of this technology do not act unfairly is needed. Furthermore, as smartphone technology becomes cheaper we should expect the opportunity for bitcoin and blockchain solutions to disrupt incumbents to grow not just in Africa but Worldwide as well. Blockchain technology will also be critical in addressing corruption in the Land sector. Issues such as duplication of Title Deeds as well as unlawful transfer of land properties will become difficult if not impossible should a decentralized and distributed ledger that is public be used to permanently record these transactions. Existing centralized systems allow for intermediaries to tamper with records as their databases can be interfered with quite easily. These technologies can be deployed across many sectors to reduce costs and enhance efficiency. People should not look at Bitcoin as a currency alone as that is really only its first application similar to the manner in which email was the first pervasive application of the Internet, which has since developed to include other applications such as Web, Mobile and even Social media applications.

Kenya and Africa, have the opportunity to lead the World in utilizing innovative and disruptive Blockchain technologies such as Bitcoin.

This article is adapted from the eBook published by BitHub Africa titled, The Blockchain Opportunity and an article by our Founder John Karanja titled, Understanding Bitcoin and its implications for the future.