BitHub.Africa was invited by Bankable Frontier Associates, a global strategy consulting firm, to speak to representatives from African Central Banks and Regulators at the Digital Finance Services(DFS) Workshop hosted at the Kenya School of Monetary Studies in Nairobi.

John Karanja, our Lead Consultant gave a presentation on The Blockchain Opportunity for Financial Inclusion which covered the use of Blockchain technology for Credit Scoring. This presentation was informed by the recent law passed by the Kenyan parliament capping interest rates at 4.5% above the Central Bank Rate (CBR). This law effectively ensures that monthly interest rates do not exceed 14.5%. The law was passed due to huge outcry from the Kenyan loan borrowers due to high interest rates.

John presented on the how Blockchain technology could bring transparency to the lending industry by allowing the different parties involved i.e. Lenders, Borrower and Regulators to securely audit lending transactions.

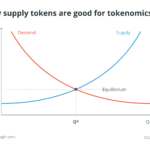

- Lenders would be able to asses a borrowers true/fair credit risk.

- Borrowers would be rewarded for paying loans on time.

- Regulators would have transparency into loans issued by lenders and mitigate against massive loan defaults and subsequent bank loans.

View full presentation below.

John was also able to briefly take the workshop attendees through Blockchain and Bitcoin technology as they had many questions and concerns revolving around the technology. The Central Bank of Kenya in December 2015 issued a public notice warning against the use of Crypto-Currencies due to system risks. BitHub.Africa has written a response titled The Blockchain Opportunity, here.

BitHub.Africa will continue to engage regulators across the continent given the opportunity, to advocate for use of Blockchain technology to solve local problems wherever possible.

The Blockchain Opportunity for Financial Inclusion by BitHub Africa on Scribd